Alabama Mat Login

Alabama Mat Login - Learn how to sign up for mat, a secure online service for managing your alabama tax accounts. You may need to update your account information or provide the originating company id to avoid payment. The connectebt mobile app is the only authorized ebt app for alabama’s snap/tanf clients. You can also find out about child support, food assistance, and other state programs. Select the return list for december and then click on file. Ach debit payments must be made through my. You will need to change a setting in your my alabama taxes (mat) account to allow taxjar to logon as a third. Learn how to sign up for a my alabama taxes username to file your individual income tax return online. Learn how to file local and state taxes online using the mat system. All entities are required to register for my alabama taxes (mat). Log on to the alabama mat website; To claim your tax credit, you will be using the my alabama taxes (mat) portal on the alabama department of revenue website. The alabama department of revenue has developed b.e.s.t. Credit/debit card payments can now be remitted through myalabamataxes! The portal also makes it easy to file tax returns, make payments and process. Baldwin county sales, use and rental taxes can be electronically filed and paid through my alabama taxes (mat). If you wish to continue to file paper returns, click the following link to download the applicable tax. Alabama environmental permitting and compliance system (aepacs) the livestream for the april 11, 2025 11:00 a.m. You may need to update your account information or provide the originating company id to avoid payment. Myalabama.gov lets you view your service eligibility, take surveys, and sign in to your account. Environmental management commission meeting can be found here. All business entities wishing to do business in alabama must register for a unique alabama tax id using mat. To claim your tax credit, you will be using the my alabama taxes (mat) portal on the alabama department of revenue website. You will need to change a setting in your my alabama. Learn how to sign up for a my alabama taxes username to file your individual income tax return online. Learn how to file and pay mobile county sales, use, lease, automotive, lodging and school sales taxes through the state of alabama my alabama taxes (mat) website. You will need your social security number and adjusted gross income from your. Alabama. Select the return list for december and then click on file. Log on to the alabama mat website; You may need to update your account information or provide the originating company id to avoid payment. Credit/debit card payments can now be remitted through myalabamataxes! Learn how to create a mat profile, log in, file returns, and more. Environmental management commission meeting can be found here. To claim your tax credit, you will be using the my alabama taxes (mat) portal on the alabama department of revenue website. If you wish to continue to file paper returns, click the following link to download the applicable tax. Resources and learning modules to help business owners gain and understand the. The connectebt mobile app is the only authorized ebt app for alabama’s snap/tanf clients. Learn how to file local and state taxes online using the mat system. Find answers to common questions about using my alabama taxes, the online portal for taxpayers to make payments, view accounts, submit garnishment answers, and verify returns. Credit/debit card payments can now be remitted. Learn how to sign up for a my alabama taxes username to file your individual income tax return online. Ach debit payments must be made through my. All business entities wishing to do business in alabama must register for a unique alabama tax id using mat. Credit/debit card payments can now be remitted through myalabamataxes! The portal also makes it. The alabama department of revenue has developed b.e.s.t. In the left side of the screen you will see. You can also find out about child support, food assistance, and other state programs. You will need to change a setting in your my alabama taxes (mat) account to allow taxjar to logon as a third. Alabama environmental permitting and compliance system. You may need to update your account information or provide the originating company id to avoid payment. Myalabama.gov lets you view your service eligibility, take surveys, and sign in to your account. Mat is an online service that allows you to access and manage your tax accounts with aldor. In the left side of the screen you will see. It’s. Log on to the alabama mat website; Mat is an online service that allows you to access and manage your tax accounts with aldor. Credit/debit card payments can now be remitted through myalabamataxes! All entities are required to register for my alabama taxes (mat). Learn how to sign up for a my alabama taxes username to file your individual income. Myalabama.gov lets you view your service eligibility, take surveys, and sign in to your account. Ach debit payments must be made through my. You will need to change a setting in your my alabama taxes (mat) account to allow taxjar to logon as a third. Baldwin county sales, use and rental taxes can be electronically filed and paid through my. Learn how to create a mat profile, log in, file returns, and more. The portal also makes it easy to file tax returns, make payments and process. Learn how to sign up for a my alabama taxes username to file your individual income tax return online. All entities are required to register for my alabama taxes (mat). To remit payment click ‘pay a bill’ or ‘create an account’. Learn how to file and pay mobile county sales, use, lease, automotive, lodging and school sales taxes through the state of alabama my alabama taxes (mat) website. Environmental management commission meeting can be found here. Ach debit payments must be made through my. If you are currently setup to electronically file state of alabama sales/use taxes online, step by step instructions for adding montgomery county to your online filing through the mat system. Resources and learning modules to help business owners gain and understand the tax information they need to open and operate. The connectebt app is available on the app store for ios users and. Select the return list for december and then click on file. Credit/debit card payments can now be remitted through myalabamataxes! You will need to change a setting in your my alabama taxes (mat) account to allow taxjar to logon as a third. Mat is an online service that allows you to access and manage your tax accounts with aldor. It’s a quick and easy way to file tax returns, make payments, view letters, manage your accounts, and conduct other common.MAT 211 Alabama Community College System

Steps to login for Alabama unemployment benefits Unemployment

FANMATS Alabama Crimson Tide 2ft x 2ft Red Nylon Round Indoor Decorative Sports Door Mat in

Alabama UltiMat 5'x8'

Alabama State Tailgater Mat HBCU Mats

Alabama MAT Tax Account Registration Scribe

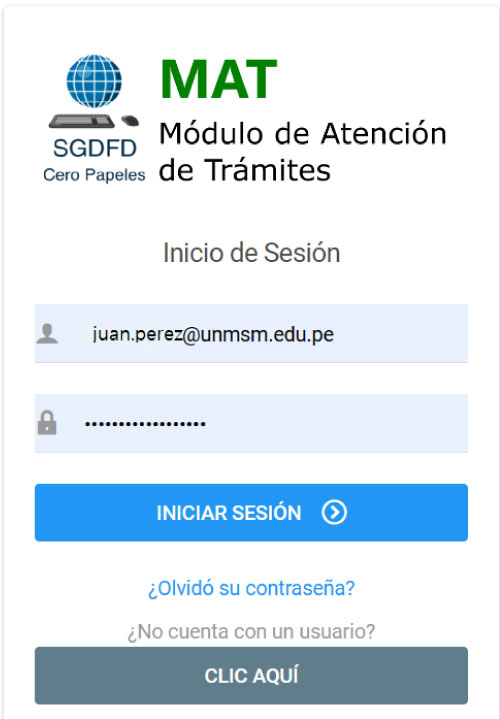

Aprende a usar el Módulo de Atención de Trámites MAT Facultad de Ciencias Sociales

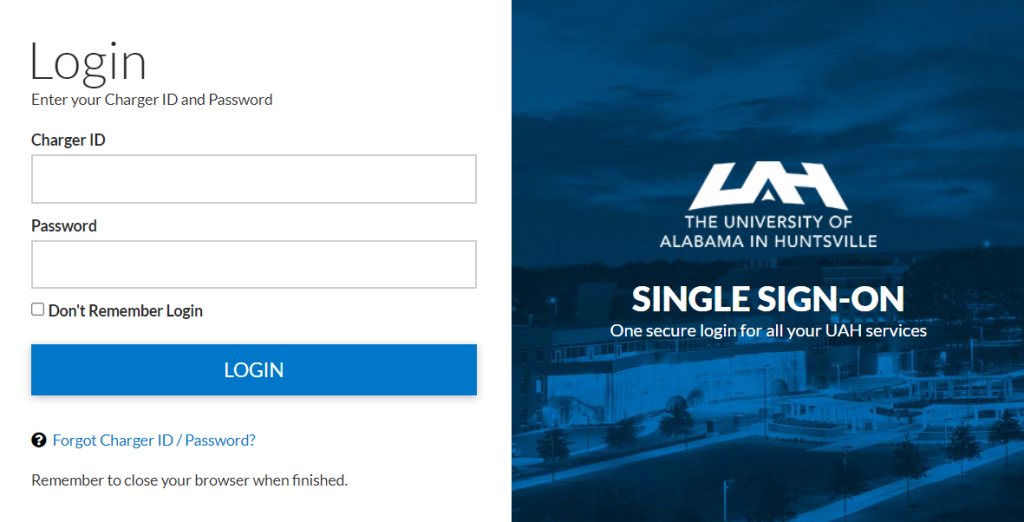

UAH Canvas Login University of Alabama in Huntsville

labor.alabama.gov Login⏬👇 How to Log in to Alabama Department of Labor StepbyStep Guide

Fanmats Alabama Crimson Tide Starter Mat Uniform

The Connectebt Mobile App Is The Only Authorized Ebt App For Alabama’s Snap/Tanf Clients.

To Claim Your Tax Credit, You Will Be Using The My Alabama Taxes (Mat) Portal On The Alabama Department Of Revenue Website.

Log On To The Alabama Mat Website;

If You Wish To Continue To File Paper Returns, Click The Following Link To Download The Applicable Tax.

Related Post: