Kentucky Withholding Employer Login

Kentucky Withholding Employer Login - Choose to pay directly from your. To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue one stop business portal. Taxpayers may file returns, view previously filed online returns, amend returns, request refunds and credit forwards as well as the ability to access the. All employers are required to virtually submit and pay income tax withholding for periods beginning on or after 1 january 2022. In order to access your wraps account & see the businesses you are associated with, you will need to login using your wraps email address that was associated with your businesses. Commonwealth of kentucky city of cadiz. Register now to access the tax portal. Complete the tax registration application (form 10a100). Don't have an account yet? Click here to submit a request. To pay a bill, an estimate/corporation, an estimate/individual, or an extension payment for your nonresident withholding (nrwh) tax: You must have a federal employment. Complete the tax registration application (form 10a100). Check the kentucky department of revenue website to find out what you'll need for registration. Register now to access the tax portal. Company information * would you like to submit an annual or quarterly report? All employers are required to virtually submit and pay income tax withholding for periods beginning on or after 1 january 2022. Taxpayers may file returns, view previously filed online returns, amend returns, request refunds and credit forwards as well as the ability to access the. In order to access your wraps account & see the businesses you are associated with, you will need to login using your wraps email address that was associated with your businesses. 150), this process has become. If you are currently using other mfa options (phone or symantec vip), no. Please note that some of the screens and information required in the. In order to access your wraps account & see the businesses you are associated with, you will need to login using your wraps email address that was associated with your businesses. To make kentucky withholding. To make kentucky withholding tax payments, you must be registered with the kentucky department of revenue one stop business portal. Please note that some of the screens and information required in the. Employers may now file their withholding tax returns electronically. If you are currently using other mfa options (phone or symantec vip), no. In order to access your wraps. All employers are required to virtually submit and pay income tax withholding for periods beginning on or after 1 january 2022. Employers may now file their withholding tax returns electronically. Please click here to sign in to your account. Commonwealth of kentucky city of cadiz. Complete the tax registration application (form 10a100). Choose to pay directly from your. Taxpayers may file returns, view previously filed online returns, amend returns, request refunds and credit forwards as well as the ability to access the. Register now to access the tax portal. If you are currently using other mfa options (phone or symantec vip), no. 150), this process has become. Employers may now file their withholding tax returns electronically. Registering for a withholding tax account: Taxpayers may file returns, view previously filed online returns, amend returns, request refunds and credit forwards as well as the ability to access the. Employers in kentucky are required to register for a withholding tax account with the department of revenue. Check the kentucky department of. Employers in kentucky are required to register for a withholding tax account with the department of revenue. Employers may now file their withholding tax returns electronically. Commonwealth of kentucky city of cadiz. Please click here to sign in to your account. Check the kentucky department of revenue website to find out what you'll need for registration. Please note that some of the screens and information required in the. Registering for a withholding tax account: Employers may now file their withholding tax returns electronically. Complete the tax registration application (form 10a100). If you were previously using okta verify, please update your mfa method to the forgerock authenticator. Click here to submit a request. Please note that some of the screens and information required in the. Employers in kentucky are required to register for a withholding tax account with the department of revenue. Taxpayers may file returns, view previously filed online returns, amend returns, request refunds and credit forwards as well as the ability to access the. Check the. © 2025 commonwealth of kentucky. Please note that some of the screens and information required in the. Taxpayers may file returns, view previously filed online returns, amend returns, request refunds and credit forwards as well as the ability to access the. Employers in kentucky are required to register for a withholding tax account with the department of revenue. 150), this process. Employers in kentucky are required to register for a withholding tax account with the department of revenue. 150), this process has become. Click here to submit a request. Commonwealth of kentucky city of cadiz. © 2025 commonwealth of kentucky. Register now to access the tax portal. You must have a federal employment. Taxpayers may file returns, view previously filed online returns, amend returns, request refunds and credit forwards as well as the ability to access the. All kentucky wage earners are taxed at a flat 5% tax rate with a standard deduction allowance annually adjusted by the department Company information * would you like to submit an annual or quarterly report? If you were previously using okta verify, please update your mfa method to the forgerock authenticator. Registering for a withholding tax account: Check the kentucky department of revenue website to find out what you'll need for registration. To pay a bill, an estimate/corporation, an estimate/individual, or an extension payment for your nonresident withholding (nrwh) tax: Please note that some of the screens and information required in the. In order to access your wraps account & see the businesses you are associated with, you will need to login using your wraps email address that was associated with your businesses.Kentucky Nonresident Withholding Tax 2024 2025

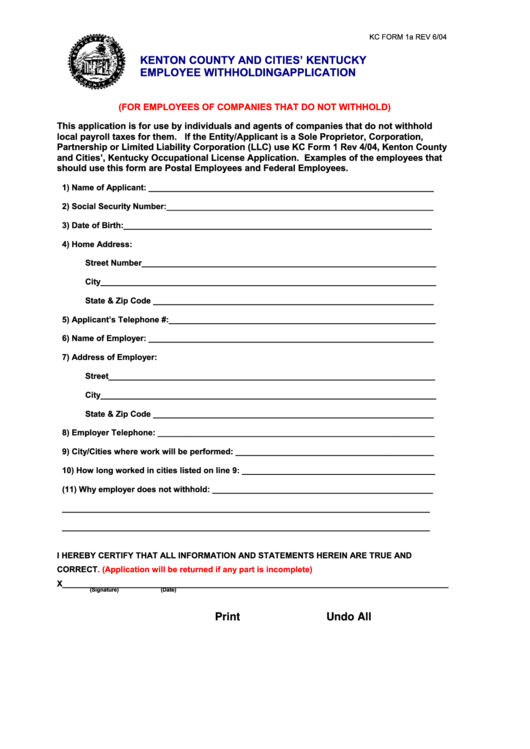

Kenton County Cities Kentucky Employee S Quarterly Withholding Form

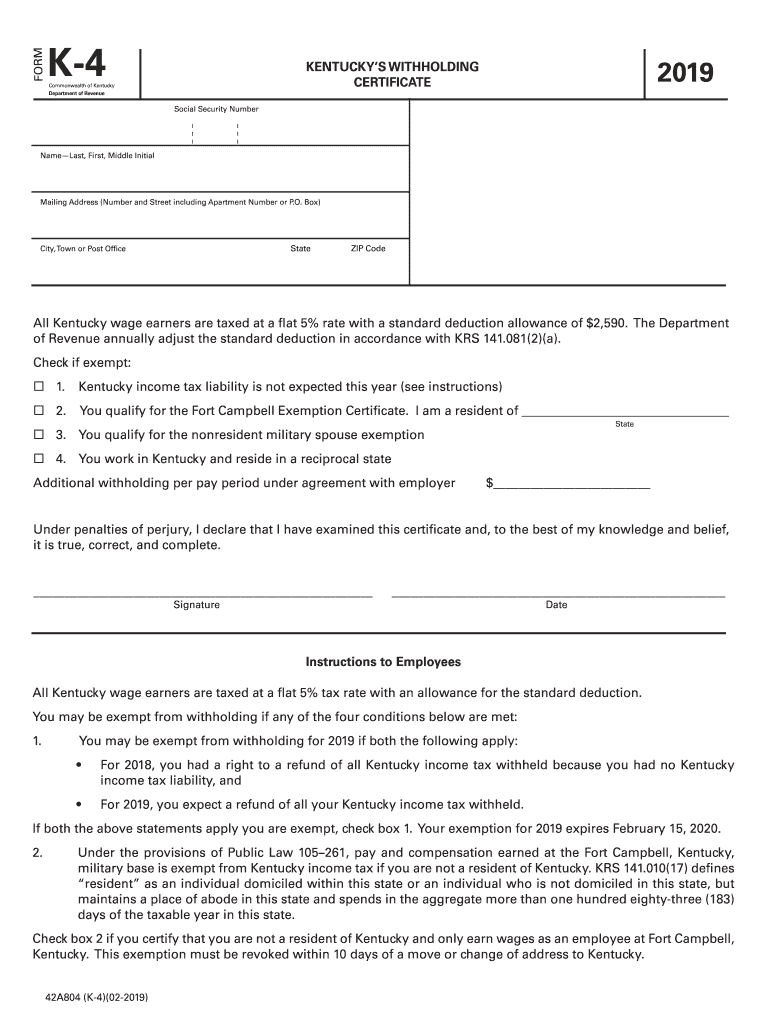

Kentucky K4 App

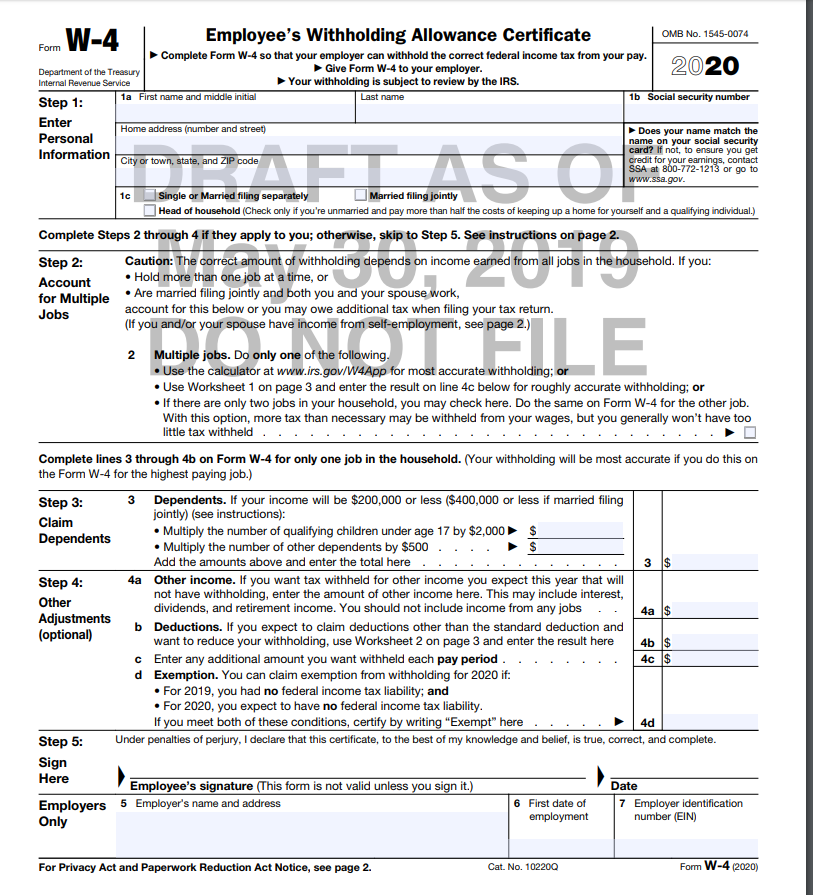

Kentucky Employee Withholding Form 2023 Printable Forms Free Online

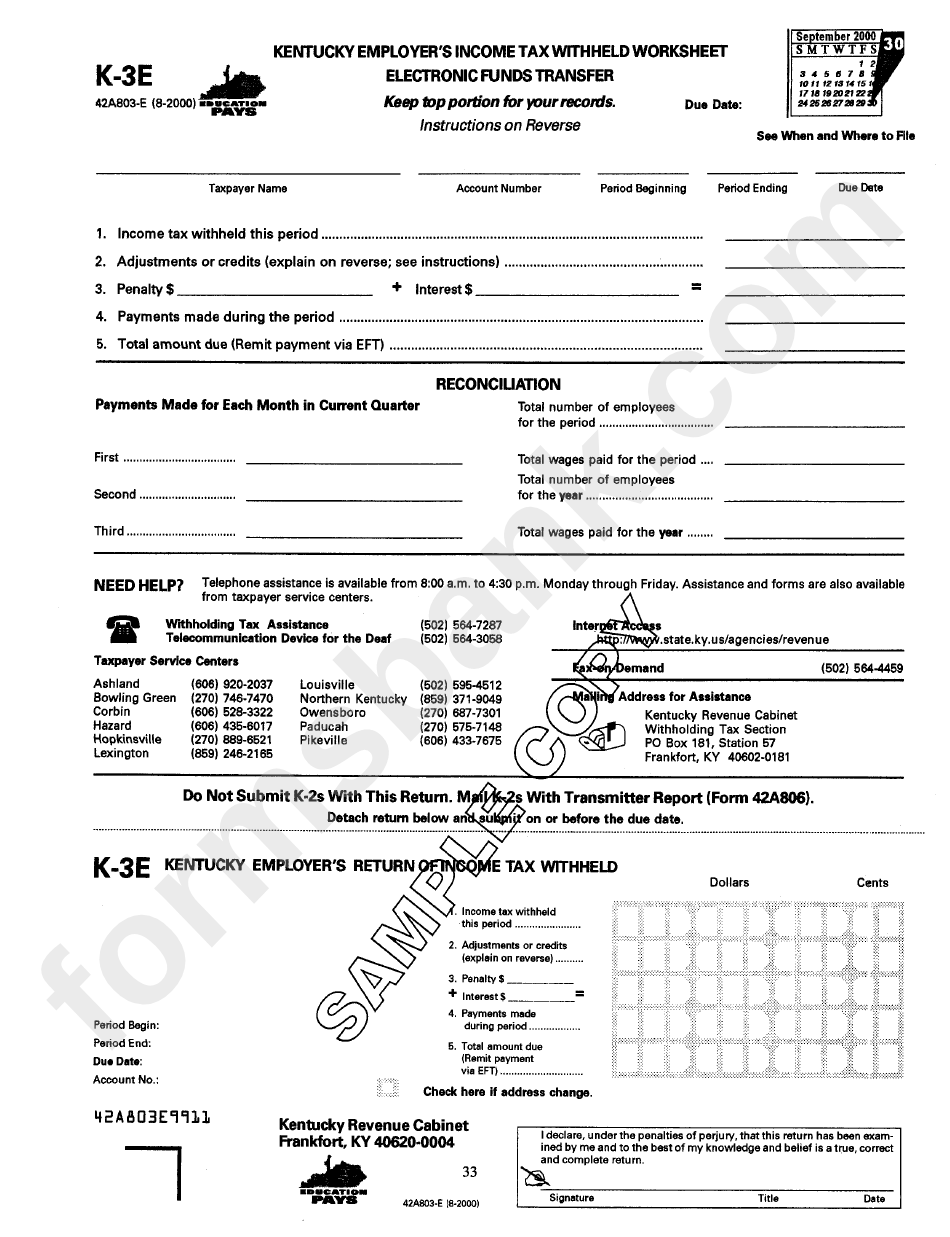

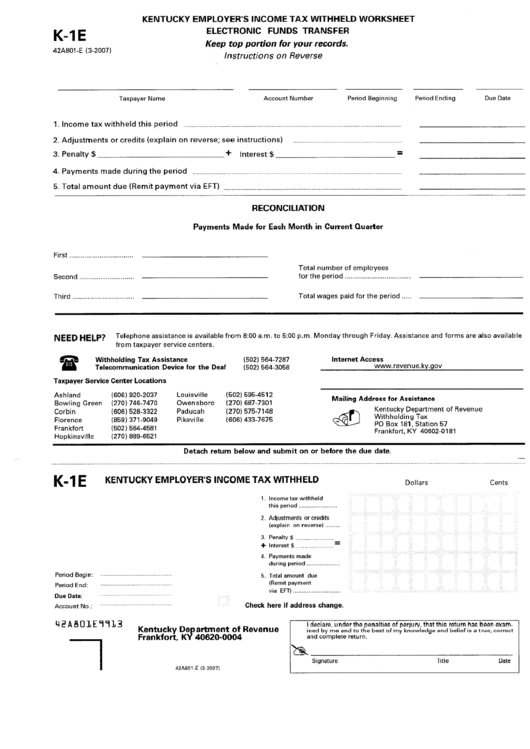

Form K3e Kentucky Employer'S Tax Withheld Worksheet printable pdf download

Form K4E Commonwealth Of Kentucky DEPARTMENT OF REVENUE 2008 Special Withholding Exemption

Ky State Employee Withholding Form

Fillable Kenton County And Cities' Kentucky Employee Withholding Application Form printable pdf

Form K1e Kentucky Employer'S Tax Withheld Worksheet printable pdf download

All Employers Are Required To Virtually Submit And Pay Income Tax Withholding For Periods Beginning On Or After 1 January 2022.

Don't Have An Account Yet?

If You Are Currently Using Other Mfa Options (Phone Or Symantec Vip), No.

Choose To Pay Directly From Your.

Related Post: