Md529 Login

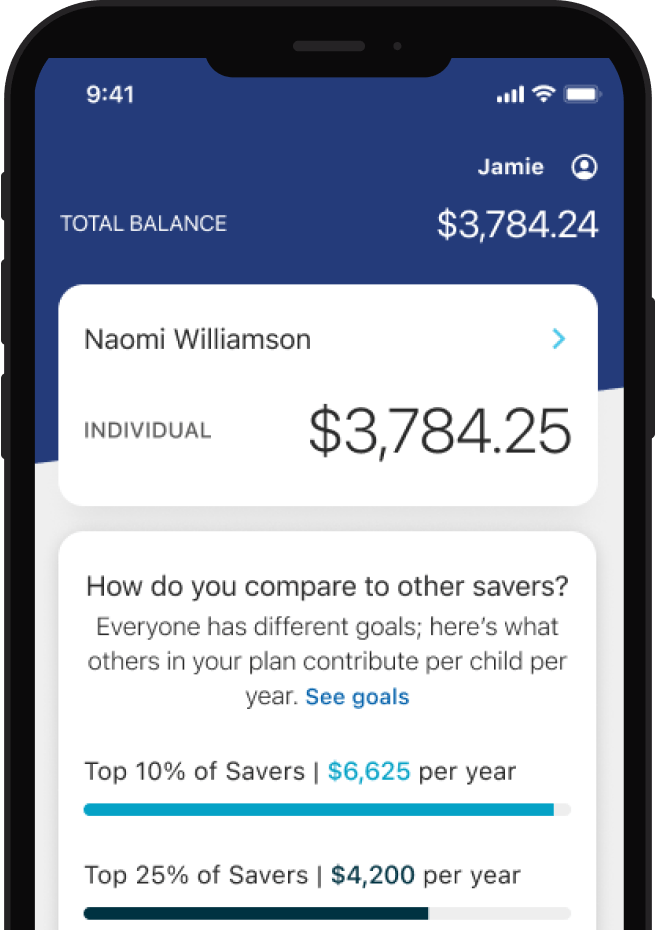

Md529 Login - To end your session, select the log off button, or take no action. If you've forgotten your password as well, you can reset it after receiving your username. Log in to your maryland college investment plan account and apply. If you have one child and you contribute $2,500 to their college fund this year, you’ll get a. Sign up for a maryland 529 plan to help save for college. For general inquiries about maryland 529, please email: Michelle winner, director of marketing. Learn about the investment options, state contribution program, and how. If this is your first time logging into your account since our transition to the new maryland college investment plan. See the plans below to take advantage of the tax deduction available to maryland residents. Michelle winner, director of marketing. Log in to your maryland college investment plan account and apply. For public information act requests, please contact: If this is your first time logging into your account since our transition to the new maryland college investment plan. If you've forgotten your password as well, you can reset it after receiving your username. With a maryland 529 plan, you can get a $2,500 tax deduction per year per account. Welcome to the maryland college investment plan account owner portal. To stay logged in, select the continue button below. Please enter your username and password. You can also download and print an application. Give your child a head start on their future education with a 529 plan. To stay logged in, select the continue button below. Michelle winner, director of marketing. Welcome to the maryland college investment plan account owner portal. For public information act requests, please contact: You can also download and print an application. Manage your account anywhere, anytime. If there is a username for your account, we will send it to this email address. Michelle winner, director of marketing. If you have one child and you contribute $2,500 to their college fund this year, you’ll get a. Give your child a head start on their future education with a 529 plan. With a maryland 529 plan, you can get a $2,500 tax deduction per year per account. To end your session, select the log off button, or take no action. Sign up for a maryland 529 plan to help save for college. Check your account balance, transaction. To end your session, select the log off button, or take no action. Sign up for a maryland 529 plan to help save for college. Learn about the investment options, state contribution program, and how. Check your account balance, transaction history, and investment allocations. Whether you are a resident of the state or not, consider using a maryland 529 plan. Whether you are a resident of the state or not, consider using a maryland 529 plan to invest for your college. Manage your account anywhere, anytime. See the plans below to take advantage of the tax deduction available to maryland residents. If you've forgotten your password as well, you can reset it after receiving your username. Secure login portal for. See the plans below to take advantage of the tax deduction available to maryland residents. For public information act requests, please contact: Secure login portal for my529 account management. Welcome to the maryland college investment plan account owner portal. Sign up for a maryland 529 plan to help save for college. Learn about the investment options, state contribution program, and how. Sign up for a maryland 529 plan to help save for college. Check your account balance, transaction history, and investment allocations. To end your session, select the log off button, or take no action. For public information act requests, please contact: Give your child a head start on their future education with a 529 plan. If there is a username for your account, we will send it to this email address. To end your session, select the log off button, or take no action. See the plans below to take advantage of the tax deduction available to maryland residents. If you. If you've forgotten your password as well, you can reset it after receiving your username. Whether you are a resident of the state or not, consider using a maryland 529 plan to invest for your college. To stay logged in, select the continue button below. Give your child a head start on their future education with a 529 plan. Secure. To end your session, select the log off button, or take no action. Check your account balance, transaction history, and investment allocations. You can also download and print an application. Open an account and start saving for college today. Give your child a head start on their future education with a 529 plan. Secure login portal for my529 account management. Please enter your username and password. Learn about the investment options, state contribution program, and how. To stay logged in, select the continue button below. Michelle winner, director of marketing. Manage your account anywhere, anytime. If there is a username for your account, we will send it to this email address. With a maryland 529 plan, you can get a $2,500 tax deduction per year per account. If you've forgotten your password as well, you can reset it after receiving your username. To end your session, select the log off button, or take no action. Use the tabs to view the save4college state. Open an account and start saving for college today. Check your account balance, transaction history, and investment allocations. Sign up for a maryland 529 plan to help save for college. Welcome to the maryland college investment plan account owner portal. Log in to your maryland college investment plan account and apply.Families not satisfied with Maryland 529's temporary fix for frozen accounts YouTube

Maryland 529

Addressing issues with Maryland 529 YouTube

5 Shocking Md State Refund Myths Debunked

Maryland 529 plan review Maryland prepaid trust YouTube

Maryland 529 Plan Compass Advocacy Legal Services in MD

Invest in Their Future with Maryland 529

Click here to bookmark your login page my529

Invest in Their Future with Maryland 529

Maryland 529 New Account Enrollment Form Enrollment Form

Whether You Are A Resident Of The State Or Not, Consider Using A Maryland 529 Plan To Invest For Your College.

For Public Information Act Requests, Please Contact:

You Can Also Download And Print An Application.

See The Plans Below To Take Advantage Of The Tax Deduction Available To Maryland Residents.

Related Post: