Wage Filing Login

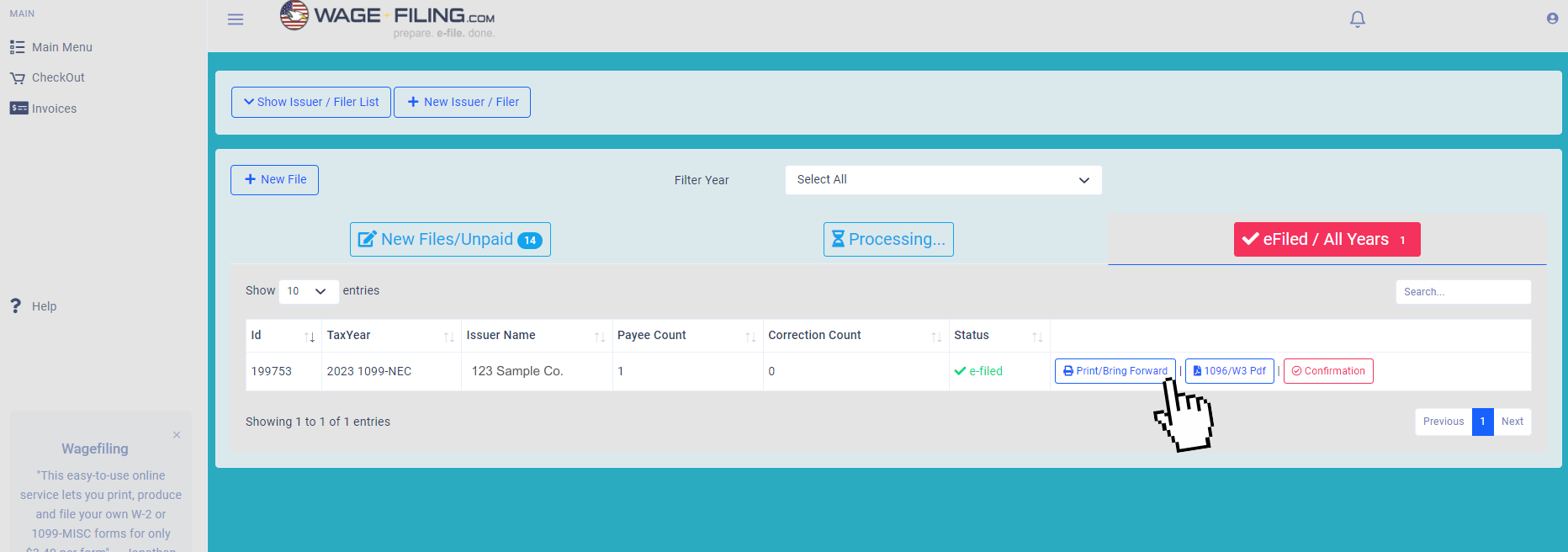

Wage Filing Login - If you do not remember your user id or password, select forgot password or. Simply click “start filing” to create a. Sign in to continue to wagefiling. Alabama department of labor will collect basic employer information that will aid in accessing available applications. Log in to your business online services account. To help employers stay in compliance and improve processing efficiency, all 1st quarter 2025 tax and wage reports (due april 30, 2025) must be filed electronically.paper. Employers with fewer than 25. Businesses and appointed representatives use bso to report wages, manage payee reports, verify social security numbers, and conduct other services online. Passwords must have at least one digit. Start at the bso welcome page. Wage file upload and w2 online remain available to use through business services online. You must use a social security online account, id.me or login.gov credential to gain access to the bso application. If you do not remember your user id or password, select forgot password or. If you used unemployment tax services in the past, sign in with your previous user id and password. File new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Please use mytax illinois for all your state of illinois tax needs, including the monthly and quarterly wage filing requirements. Employers with fewer than 25. Using mytax illinois monthly wage filing must be done via mytax illinois, the department's online tax filing and wage reporting application. Passwords must have at least one digit. Employers that are already registered on mytax. Select the desired form type and issuer (company) the new file will be located in new files/unpaid page. Passwords must be at least 8 characters. You can either log in or create an. Log into your wagefiling account and select + new file. Ssa is currently not accepting new ewr web service users/consolidators. Passwords must be at least 8 characters. Log into your wagefiling account and select + new file. If you do not remember your user id or password, select forgot password or. If you used unemployment tax services in the past, sign in with your previous user id and password. Using mytax illinois monthly wage filing must be done via mytax. Wage file upload and w2 online remain available to use through business services online. Passwords must be at least 8 characters. File new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Employers with fewer than 25. Log in to your wageworks participant account to manage your spending accounts and access resources. Log into your wagefiling account and select + new file. Businesses and appointed representatives use bso to report wages, manage payee reports, verify social security numbers, and conduct other services online. Using mytax illinois monthly wage filing must be done via mytax illinois, the department's online tax filing and wage reporting application. You must use a social security online account,. Wage file upload and w2 online remain available to use through business services online. Create a new account or login for free using the links below. Passwords must have at least one non alphanumeric character. Texas workforce commission (twc) rules 815.107 and 815.109 require all employers to report unemployment insurance (ui) wages and to pay their quarterly ui taxes electronically.. You can either log in or create an. You must use a social security online account, id.me or login.gov credential to gain access to the bso application. File new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Start at the bso welcome page. Create a new account or login for free using the links below. Sign in to continue to wagefiling. File new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Passwords must have at least one digit. Wage file upload and w2 online remain available to use through business services online. Passwords must be at least 8 characters. Please use mytax illinois for all your state of illinois tax needs, including the monthly and quarterly wage filing requirements. Create a new account or login for free using the links below. Log in to your business online services account. Employers with fewer than 25. You will be able to choose your own login user id and password. Please use mytax illinois for all your state of illinois tax needs, including the monthly and quarterly wage filing requirements. Simply click “start filing” to. Start at the bso welcome page. Using mytax illinois monthly wage filing must be done via mytax illinois, the department's online tax filing and wage reporting application. Passwords must have at least one digit. Employers that are already registered on mytax. Wage file upload and w2 online remain available to use through business services online. To help employers stay in compliance and improve processing efficiency, all 1st quarter 2025 tax and wage reports (due april 30, 2025) must be filed electronically.paper. Texas workforce commission (twc) rules 815.107 and 815.109 require all employers to report. If you used unemployment tax services in the past, sign in with your previous user id and password. Passwords must have at least one digit. Log in to your business online services account. If you do not remember your user id or password, select forgot password or. Employers with fewer than 25. To help employers stay in compliance and improve processing efficiency, all 1st quarter 2025 tax and wage reports (due april 30, 2025) must be filed electronically.paper. Sign in to continue to wagefiling. Log into your wagefiling account and select + new file. Passwords must be at least 8 characters. Texas workforce commission (twc) rules 815.107 and 815.109 require all employers to report unemployment insurance (ui) wages and to pay their quarterly ui taxes electronically. Wage file upload and w2 online remain available to use through business services online. Passwords must have at least one non alphanumeric character. Please use mytax illinois for all your state of illinois tax needs, including the monthly and quarterly wage filing requirements. Start at the bso welcome page. Ssa is currently not accepting new ewr web service users/consolidators. Employers that are already registered on mytax.1099NEC WageFiling

How to create account for Assessee in Tax e Filing website? In order to submit the

Tax Login IT Portal Registration and Login for Efiling

Wagefiling Help

How to file tax return online for salaried employee?

Step by Step Tax Login & Registration Guide

Wagefiling Help

Wagefiling Help

How to login Tax efiling website ? YouTube

How to register and login on tax efiling website to file tax return /PF HELPLINE

File New Jersey Payroll Tax Returns, Submit Wage Reports, And Pay Withholding Taxes:

Log In To Your Wageworks Participant Account To Manage Your Spending Accounts And Access Resources.

Businesses And Appointed Representatives Use Bso To Report Wages, Manage Payee Reports, Verify Social Security Numbers, And Conduct Other Services Online.

This Filing Season, Direct File Includes New Features To.

Related Post: